Menu

Newsletter

Sign up to our newsletter

Email David Kirk direct by clicking on his name.

Kirks Insolvency offers MVL services to businesses across the UK from our various office locations.

We want to charge you as little as possible for this service. To help us achieve that the more you can do before you appoint us the better. If you are able to;

It also helps if all of your VAT and PAYE returns are up to date.

Your accountant will also need to have prepared annual accounts to the end date of trading and have worked out the Corporation Tax due. This may have to be paid after the date of liquidation.

If you are expecting to pay just 10% tax then you need to check that you qualify for Business Asset Disposal Relief. You would normally ask your accountant to check this for you or you can visit www.gov.uk/business-asset-disposal-relief.

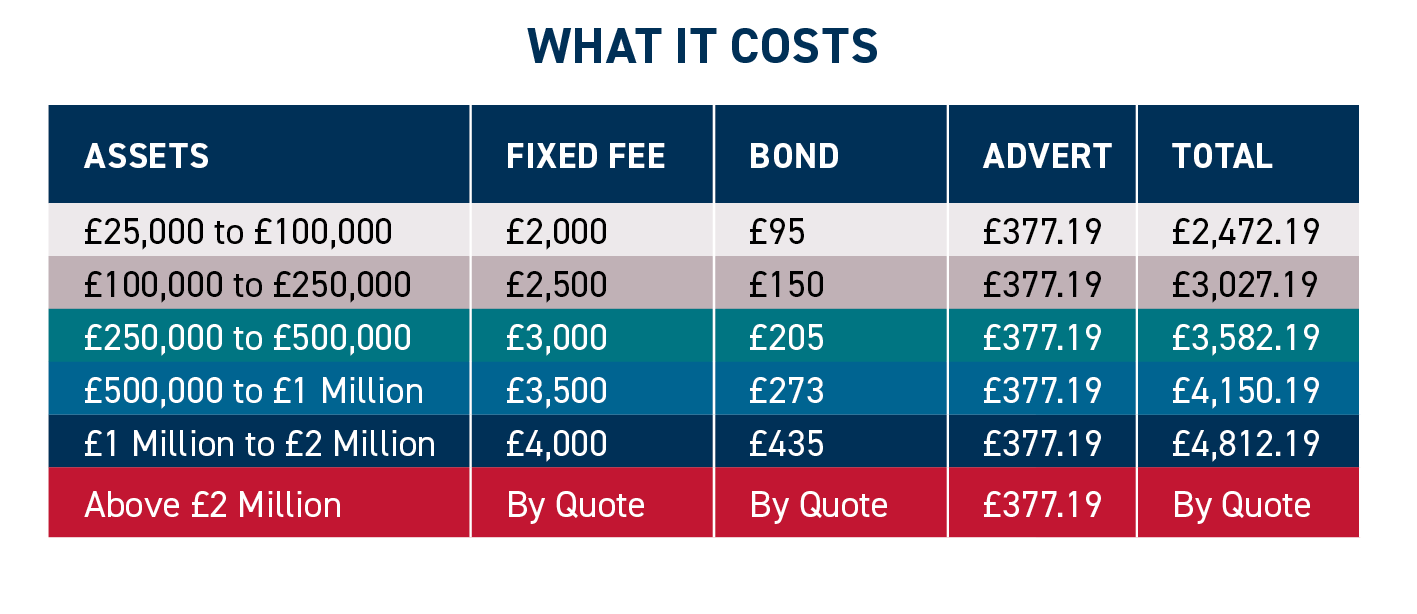

The above costs are plus VAT which can usually be reclaimed. If you have more than five shareholders or creditors we may need to quote a revised fixed fee. Find out more about the process, what we need and the costs of a members voluntary liquidation.

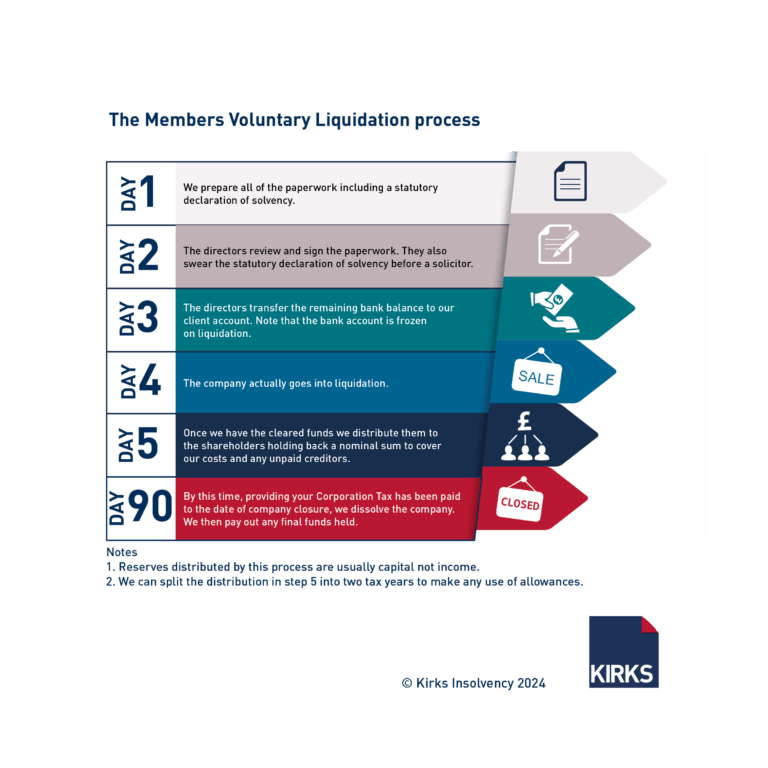

We prepare all of the necessary MVL paperwork including an indemnity that we ask you to sign. We then aim to distribute the funds to you within the first week of liquidation, only holding back funds to cover:-

Members’ Voluntary Liquidations are used as a method of extracting company’s funds and for shareholders to claim Business Asset Disposal Relief formerly Entrepreneurs Relief (meaning the shareholders only usually pay Capital Gains Tax of 10% on the first £1 million).

Prior to instructing us you will need to take tax advice from your accountant to make sure you will qualify for the 10% tax rate on capital gains. They are welcome to ask us any questions and we can make suggestions on the timing of events.

How safe is our money with you?

It is very safe – read our Frequently Asked Questions to find out more about this.

Contact us today by phone, email or request a call back.

Sign up to our newsletter

Simply fill out the short form below and I will get back to you.

Licensed Insolvency Practitioner